Carer’s Allowance earnings limit rise from 7th April 2025

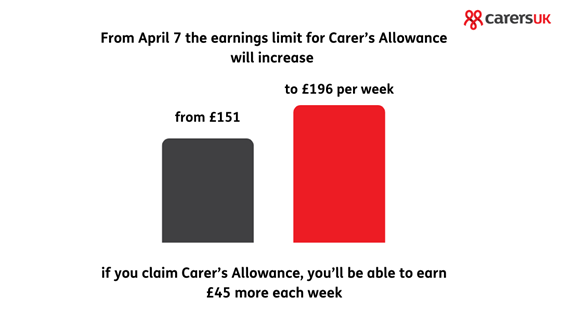

From Monday 7 April, the earnings limit for Carer’s Allowance will increase from £151 to £196 per week.

This means that, if you claim Carer’s Allowance, you’ll be able to earn £45 more each week without losing your Carer’s Allowance.

You may also be able to claim Carer’s Allowance for the first time if your earnings are below the new limit.

These changes mean that:

-

Working carers can earn up to £196 per week after certain deductions, up from £151, while keeping the allowance

-

The allowance itself will rise to £83.30 per week

-

An extra 60,000 carers will receive the money by 2029

Concerns for the future

Action for Carers welcomes this change, the largest increase in the earnings limit for Carer’s Allowance since the benefit was introduced in 1976.

However, Carer’s Allowance itself remains the lowest benefit of its kind. And proposed changes to the Personal Independence Payment (PIP) entitlement ules will also see 150,000 carers lose their Carer’s Allowance by 2029/30.

Additionally, there remain concerns over how some people have been forced to pay back the allowance, after going only slightly over the earnings threshold. More on that here, and what to do about it if you’re affected here.

How the changes might affect you

Carers UK has lots of helpful resources and information on Carer’s Allowance and how this change might affect you and your earnings. You may find it helpful to visit the following pages for information about the earnings limit, allowable expenses and Carer’s Allowance overpayments:

- Carer’s Allowance and the earnings limit | Carers UK

- Carer’s Allowance factsheet | Carers UK

- Carer’s Allowance and overpayments | Carers UK

More in the news

The BBC has a helpful article explaining what the change will mean to some carers.

Going to work is really important, it’s a sense of identity and purpose but I can only do 11 hours a week or I’ll lose the allowance,

Further advice and support

If you need advice about Carer’s Allowance or have questions about changes to the earnings limit, please get in touch with us.

You can call the ACS Helpline on 0303 040 1234, email [email protected] or text 07723 486730.

Or you can contact Carers UK:

- Helpline – advice to carers is available on 0808 808 777

- Email – for more complex queries or detailed guidance, contact [email protected]